Avoid A Money Pit: Tips For Buying A Pre-Owned Home

Purchasing a home is an exciting time, but here are some first hand suggestions on how you can avoid a money pit. Feel free to use some of my past…

Purchasing a home is an exciting time, but here are some first hand suggestions on how you can avoid a money pit. Feel free to use some of my past experiences as a little guidance.

There are potential money drains lurking throughout a pre-owned home in the form of aged-out features and appliances that need replacing or updating. So what are some of the biggest headaches and expenses when buying a previously owned home? Let’s take a look at my journey.

Age-Related Upgrades and Repairs

How old is the home you’re considering? While age alone doesn’t determine if a home is worth buying, it does have an impact on the potential costs associated with major repairs or upgrades.

Generally speaking, homes built before 1978 tend to require more attention than newer homes due to aging infrastructure and outdated building codes. That said, even newer homes may need updates depending on how many years have passed since they were built.

The home I purchased was built in 2004. Whereas, I wouldn't call it a money pit, there have been a lot of necessary repairs and replacements. Here are some age-related repairs and upgrades you should consider when shopping for your next home.

Hopefully these tips will help you avoid a money pit with your next home purchase.

Avoid a Money Pit

Roofing

Robert Ołdakowski via Getty Images

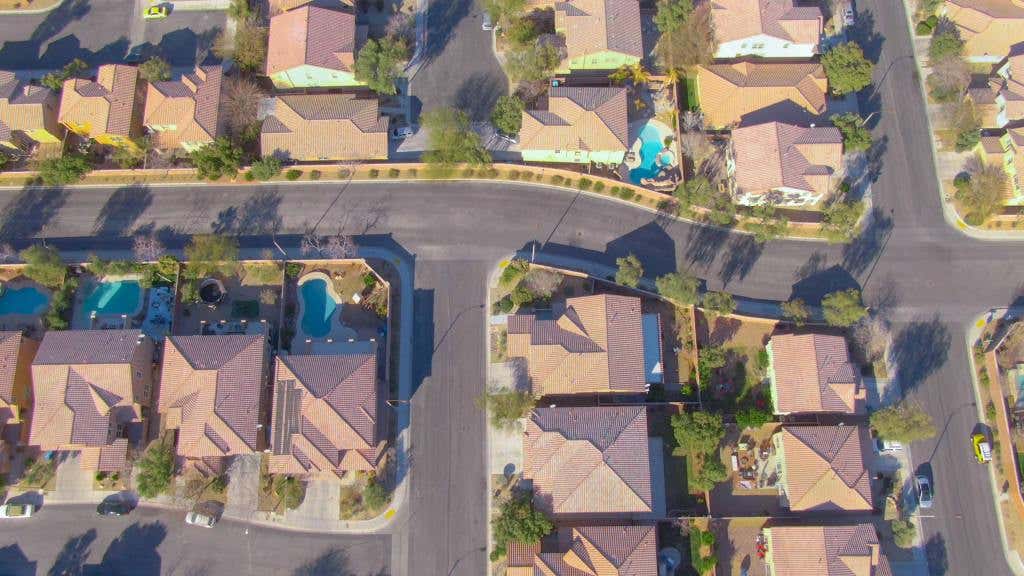

Robert Ołdakowski via Getty ImagesAsphalt shingle roofing typically lasts about 20 years before needing replaced. Tile roofs, like those in many of the Las Vegas neighborhoods, may last longer, but will still eventually need updated.

I suggest having a licensed and certified Home Inspector take a look at the condition of your roof to give you an idea of any potential problem areas. Luckily, mine was in decent shape.

Plumbing

Ole_CNX via Getty Images

Ole_CNX via Getty ImagesOlder plumbing systems are prone to issues such as leaks from corrosion, cracks, clogging and potential structural damage. In my situation, I was greeted with a costly plumbing repair only seven days after moving into my new home.

Over the years, prior to me purchasing the home, the main sewer line had become compromised by tree roots. A simple rooter was ineffective to correct the problem which required a complete replacement of the main line.

From my experience, I would highly recommend paying the extra expense to have the system inspected with a sewer scope camera prior to purchase. It could have saved me thousands.

Also, check the age of the hot water heater. An expense that comes around every 10 to 15 years. Another one I've checked off my list.

Heating and Cooling Systems

photovs via Getty Images

photovs via Getty ImagesHeating and cooling systems are expensive investments that often need replaced after 10-15 years of use. How old are the units? Have they been maintained properly? With the Environmental Protection Agency (EPA) banning the use of R-22 refrigerant, most units installed prior to January, 2020 will eventually need to be replaced with newer equipment to accommodate R-410A, a chlorine free refrigerant. Read more HERE. Does the HVAC unit(s) fall into that category? If so, plan for a major expense.

In my case, within one summer of moving in, I replaced the entire system.

With proper maintenance throughout their lifespan, however, these investments can last longer than expected which makes them far less of a headache for new homeowners down the line.

Windows

photovs via Getty Images

photovs via Getty ImagesMany window frames begin deteriorating after 10-15 years, leading to drafts and energy loss during winter months when heating bills can skyrocket if not properly insulated. Replacement windows can help reduce energy costs while also increasing overall comfort levels within the home.

My windows received a passing grade from the home inspector but are on the list of upgrades that will need to be made in the coming years.

Electrical Systems

wattanaphob via Getty Images

wattanaphob via Getty ImagesThe wiring in many older homes is not only out of date but often installed at dangerously low voltage levels. Make sure you factor in any necessary electrical work into your budget if purchasing an older home with outdated wiring.

Pools

peangdao via Getty Images

peangdao via Getty ImagesHere in Nevada, having a pool to plunge into on a hot summer day is a real benefit. But, an unmaintained pool can be an expensive curse.

First, check the age of the pool equipment. A well maintained pump should last between 8-12 years.

Also, closely inspect the condition of the plaster finish, looking for cracks and other signs of deterioration. Pools will generally need to be replastered every 10 years or so. Has it been completed recently? If not, plan accordingly.

Speaking from experience, this is a major expense.

Benefits: a freshly plastered pool looks amazing and a new, energy efficient pump will save hundreds on the power bill. Two more things checked off my list!